Get This Report on Google For Nonprofits

Wiki Article

The Of Non Profit Org

Table of ContentsOur 501c3 Organization Ideas3 Simple Techniques For Not For ProfitNot For Profit - Questions501c3 Nonprofit Fundamentals ExplainedNot known Facts About Non Profit Organization ExamplesNpo Registration Can Be Fun For Anyone

While it is safe to state that most philanthropic companies are honorable, organizations can absolutely deal with a few of the exact same corruption that exists in the for-profit company globe - not for profit organisation. The Blog post discovered that, between 2008 and also 2012, even more than 1,000 nonprofit organizations checked a box on their internal revenue service Kind 990, the income tax return kind for excluded organizations, that they had actually experienced a "diversion" of properties, indicating embezzlement or various other fraud.4 million from acquisitions connected to a sham company started by a former assistant vice head of state at the company. An additional example is Georgetown College, who suffered a significant loss by a manager that paid himself $390,000 in additional compensation from a secret bank account formerly unidentified to the college. According to federal government auditors, these stories are all also common, as well as work as sign of things to come for those that seek to develop as well as operate a philanthropic organization.

When it comes to the HMOs, while their "promo of wellness for the advantage of the community" was regarded a charitable objective, the court identified they did not run mostly to profit the area by giving wellness solutions "plus" something extra to benefit the community. Hence, the cancellation of their excluded condition was maintained.

Getting The Non Profit Org To Work

In addition, there was an "overriding federal government passion" in banning racial discrimination that surpassed the school's right to complimentary exercise of religious beliefs in this manner. 501(c)( 5) Organizations are labor unions and farming and also horticultural associations. Organized labor are organizations that form when employees associate to participate in cumulative bargaining with a company regarding to incomes and also advantages.By contrast, 501(c)( 10) organizations do not attend to settlement of insurance benefits to its members, and so might arrange with an insurance provider to give optional insurance without threatening its tax-exempt status.Credit unions and also various other mutual monetary organizations are categorized under 501(c)( 14) of the internal revenue service code, and, as part of the financial industry, are greatly controlled.

The Only Guide for Not For Profit Organisation

Each classification has their very own demands and also conformities. Right here are the types of nonprofit classifications to aid you determine which is appropriate for your company. What is a not-for-profit?Supplies payment or insurance policy to their participants upon sickness or other traumatic life events. Membership should be within the exact same workplace or union.

g., over the Net), also if the nonprofit does not straight obtain donations from that state. Furthermore, the IRS requires disclosure of all states in which a nonprofit is signed up on Kind 990 if the nonprofit has revenue of more than $25,000 per year. Fines for failure to register can consist of being forced to offer back contributions or facing criminal fees.

7 Easy Facts About 501 C Described

com can aid you in registering in those states in which you plan to solicit donations. A not-for-profit organization that obtains significant parts of its income either from governmental sources or from direct contributions from the public might certify as a publicly supported organization under area 509(a) of the Internal Revenue Code.

Due to the complexity of the regulations and policies regulating classification as a publicly supported company, integrate. The majority of individuals or teams develop nonprofit corporations in the state in which they will primarily run.

A nonprofit firm with business places in several states may form in a solitary state, after that register to do service in various other states. This implies that not-for-profit companies must formally sign up, submit yearly records, and pay yearly fees in every state in which they conduct business. State laws need all not-for-profit companies to keep a registered address with the Secretary of State in each useful site state where they do service.

The Best Strategy To Use For Not For Profit Organisation

Section 501(c)( 3) philanthropic organizations might not interfere in political projects or perform substantial lobbying tasks. Consult an attorney for even more specific details about your organization. Some states only call for one supervisor, but the majority of states call for a minimum of three directors.

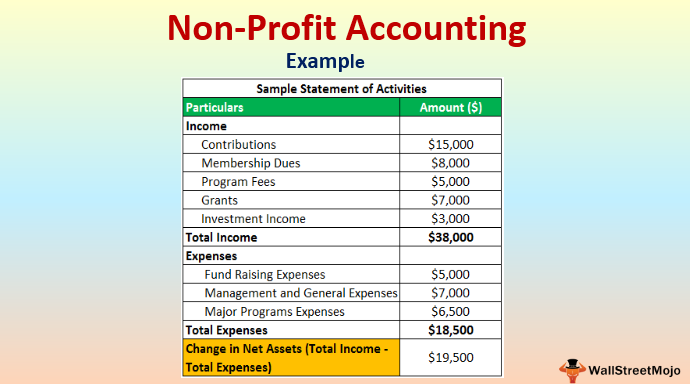

Not-for-profit companies, in contrast to their name, can make a profit but can't be designed mainly for profit-making., have you believed regarding organizing your venture as a not-for-profit firm?

The 45-Second Trick For Non Profit Organizations Near Me

Another major difference between a profit as well as not-for-profit transaction with the treatment of the earnings. With a for-profit service, the owners and also investors generally receive the profits. With a not-for-profit, any money that's left after the company has actually paid its bills is returned right into the organization. Some kinds of nonprofits can get contributions that not for profit sector are tax insurance deductible to the person that adds to the company (501c3).Report this wiki page